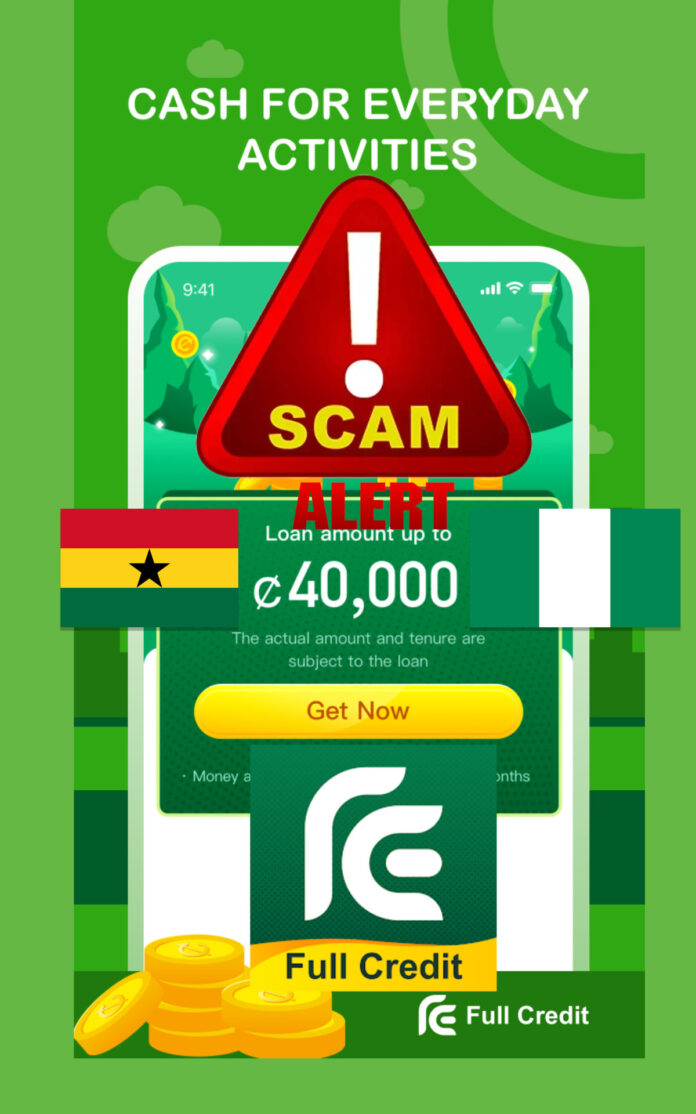

New Scam Alert!! FullCredit 2024

Empower your financial future: Ditch the scam apps and unlock responsible loan options for the life you deserve.

Say goodbye to loan app stress! Learn how to borrow smart, avoid predatory traps, and secure your financial peace of mind.

The FullCredit app pops up as a superb financial savior until you sign up for your data to be collected and used by them in their well-crafted “Terms and Conditions.” That’s when the nightmares begin.

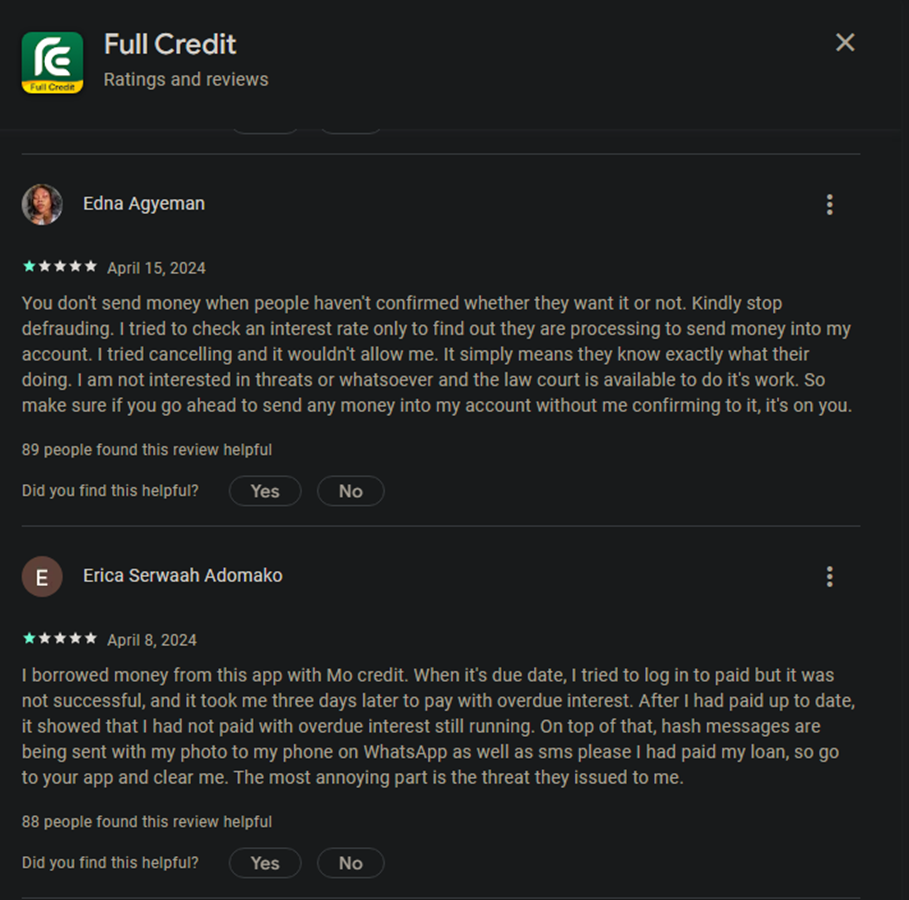

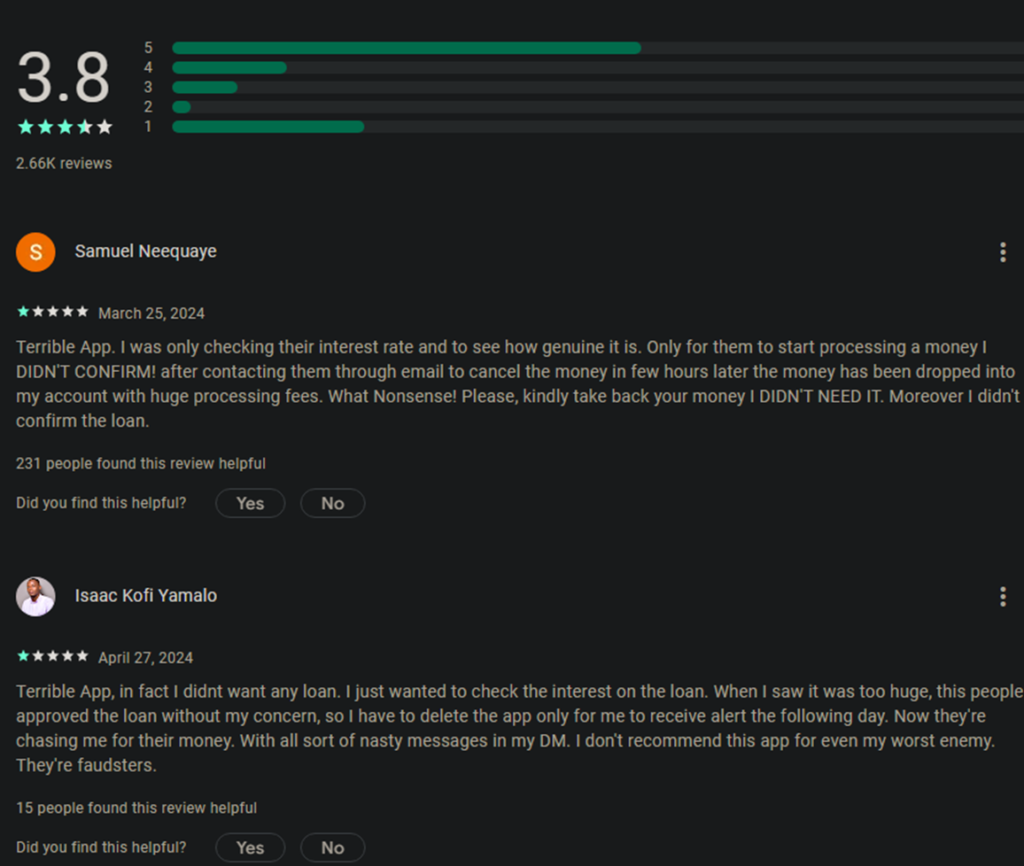

Reviews from the Play Store:

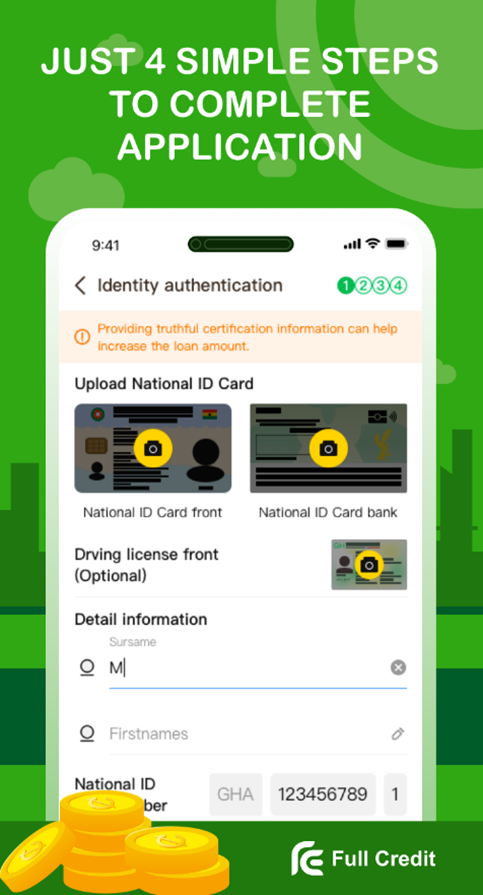

Unveiling Full Credit’s Deceptive Practices

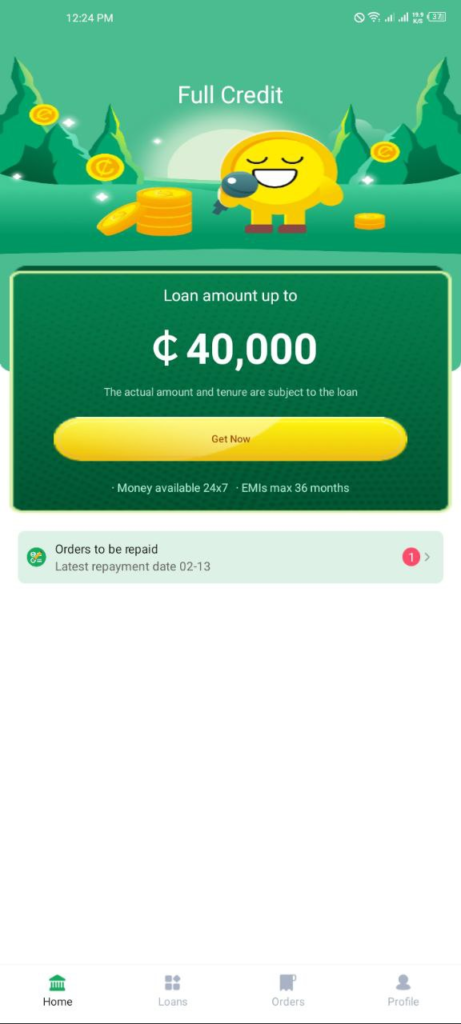

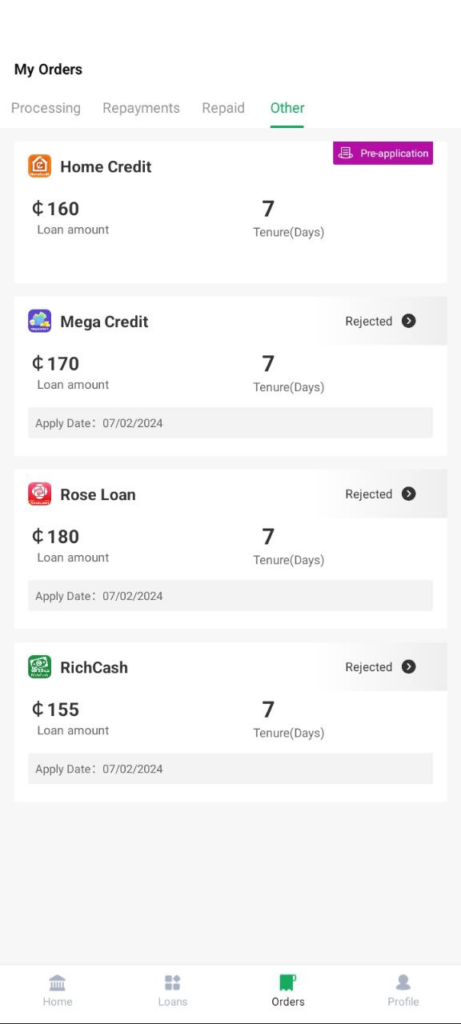

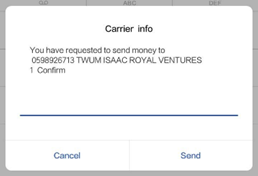

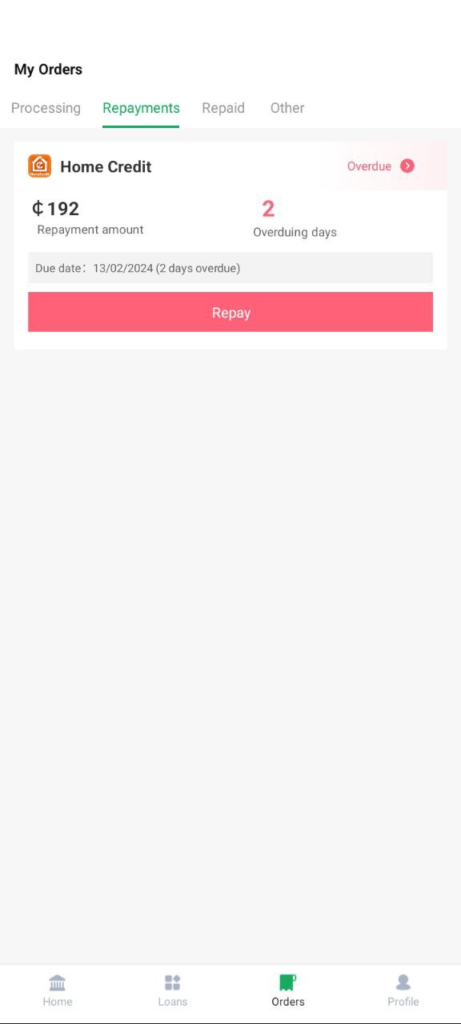

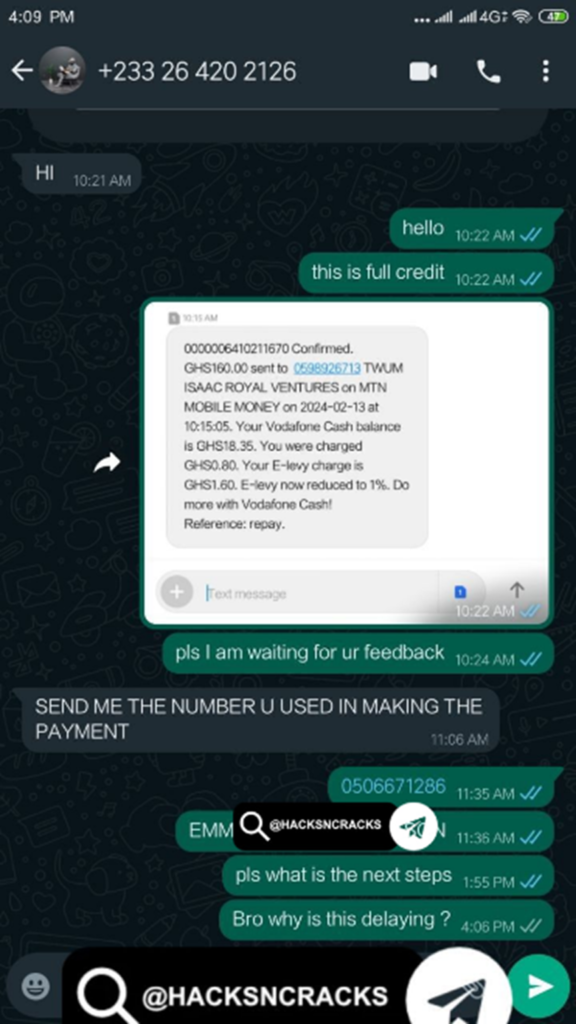

Full Credit’s deceptive practices are a cause for concern. They lure users in with false promises, hidden fees, and predatory loan terms. Let’s take a careful look at some of the evidence, including screenshots of the misleading FullCredit app with user testimonials and complaints.

1. They give you GH¢90.00 when you pressed the yellow button (Get Now)

2. They will immediately tell you to pay GH¢160.00 as repayment of your tenure in 7 working days.

3. After payment is made to them before the 7 days, they will call, saying, “You refuse to make payment, so they will increase the interest.”. That was when they started to threaten you about broadcasting your collected data to your WhatsApp contact and also online to extort money from you.

4. They will start pressuring you to pay your debt. So I decided to contact their help line, but no help came for several days.

Only to find out in the Play Store comment section that it has been going on for years now and complaints have been made but no proper action has been taken.

The Consequences of FullCredit

Using full credit can lead to potential financial and emotional harm. Borrowers may find themselves trapped in a vicious cycle of exorbitant interest rates, aggressive debt collection tactics, and damage to their credit scores.

Seeking Safe Alternatives

If you’re in Ghana and looking for mobile banking and loan services, it’s important to consider safe and trustworthy alternatives. MTN Ghana Quickloan is one of the best alternatives, highlighting their transparency, fair terms, and responsible lending practices. While there are many resources available, such as Credible and NerdWallet, it’s essential to educate yourself and avoid directly endorsing specific companies.

Emphasizing Responsible Borrowing

Responsible borrowing is crucial to maintaining financial stability. Readers should assess their needs, compare rates, understand terms, and avoid upfront fees. Share resources for financial literacy and credit counseling, empowering readers to make informed decisions about their finances.

A Call to Action

In conclusion, it is imperative that readers exercise caution when it comes to loan apps like FullCredit. Utilize the safe alternatives provided and spread awareness by sharing this information with friends, family, and the community at large. Together, we can protect ourselves and others from falling victim to scams and predatory lending practices.

Empower your financial future. Choose responsible loan options.

FullCredit Scam Alert

Techynotion.com does not host any files on its servers. All point to content hosted on third-party websites. Techynotion.com does not accept responsibility for content hosted on third-party websites and does not have any involvement in the same.